Pharmaceutical Filtration Market is Expected to Grow USD 22.54 Billion by 2032 | At CAGR 7.94%

The global pharmaceutical filtration market size was valued at USD 12.36 billion in 2024.

Shift toward Single-Use Technologies (SUTs) is a Prominent Global Pharmaceutical Filtration Market Trend”

NY, UNITED STATES, February 10, 2026 /EINPresswire.com/ -- The pharmaceutical filtration market Size represents a critical segment within the broader pharmaceutical manufacturing industry, serving as an essential component in drug development and production processes. According to Fortune Business Insights, the global pharmaceutical filtration market demonstrated robust performance in 2024, with a valuation of USD 12.36 billion. The market is projected to experience substantial expansion, growing from USD 13.21 billion in 2025 to USD 22.54 billion by 2032, representing a compound annual growth rate of 7.94% during the forecast period.— Fortune Business Insights

This remarkable growth trajectory reflects the increasing importance of filtration technologies in ensuring product safety, regulatory compliance, and manufacturing efficiency within the pharmaceutical sector. The market's expansion is driven by the critical role filtration plays in removing and inactivating contamination during drug development and manufacturing processes.

Get a Free Sample PDF - https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/pharmaceutical-filtration-market-114711

Key Market Drivers

The pharmaceutical filtration market's growth is fueled by several significant factors. The expansion of biopharmaceutical manufacturing stands as the primary driver, with the rapid development of biologics including vaccines, biosimilars, cell therapies, and personalized medicines creating substantial demand for advanced filtration systems. Pharmaceutical companies are extensively expanding their biomanufacturing capacity to meet the rising demand for effective drug products.

Major industry players are making significant investments to strengthen their filtration capabilities. In September 2025, Merck launched a USD 161.81 million filter manufacturing facility in Ireland, specifically designed to enhance in-region supply resilience. Similarly, in May 2023, 3M invested USD 146.0 million to expand its capabilities and accelerate the development and delivery of vital filtration solutions for pharmaceutical manufacturing applications.

Market Segmentation Insights

The market exhibits diverse segmentation across multiple dimensions. By type, membrane filters dominate the landscape, holding the largest market share due to their increasing usage in sterilization-grade filtration. These filters are essential in maintaining controlled microbial environments required by strict regulatory standards in sterile manufacturing processes. The cartridge filters segment is experiencing the fastest growth, projected to expand at a CAGR of 8.68% during the forecast period.

From an application perspective, final product processing commands the largest segment share at 45.5% in 2025. This dominance stems from the high demand for biologics and biosimilars in treating various diseases, coupled with increasing automation to meet growing market demands. The virus filtration segment is anticipated to grow at an impressive CAGR of 9.30% over the forecast period.

In terms of technique, microfiltration leads with a 37.5% market share in 2025, attributed to its advantages including physical bacterial and particulate removal, mild operational conditions that protect product quality, and high process efficiency. The nanofiltration segment is expected to record the highest growth rate at 10.46% CAGR.

Regional Market Dynamics

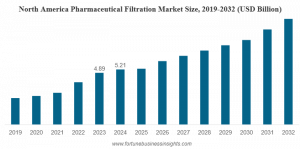

North America maintains its position as the dominant regional market, valued at USD 5.21 billion in 2024 and projected to reach USD 5.12 billion in the United States alone by 2025. This leadership is driven by increasing manufacturing activities in biologics and biosimilars, alongside substantial biopharmaceutical production growth. Strategic activities such as mergers and collaborations among key companies further strengthen the region's market position.

Europe follows as the second-largest market, expected to reach USD 3.54 billion by 2025 with a growth rate of 7.60%. The region's expansion is primarily attributed to new manufacturing facility launches and rising demand for filtration solutions. Within Europe, Germany leads with a projected valuation of USD 1.01 billion, followed by the United Kingdom at USD 0.66 billion and France at USD 0.54 billion in 2025.

The Asia Pacific region secures the third position, estimated to reach USD 3.06 billion in 2025, with China and India contributing significantly at USD 0.80 billion and USD 1.08 billion respectively. Latin America and the Middle East & Africa regions are experiencing moderate growth, with valuations of USD 0.61 billion and USD 0.16 billion respectively for 2025.

Emerging Trends and Opportunities

A prominent trend shaping the market is the shift toward Single-Use Technologies. These systems eliminate the need for cleaning and sterilization between production batches, significantly reducing downtime and validation costs while minimizing cross-contamination risks. Leading manufacturers are expanding their single-use filtration portfolios, introducing scalable systems for both upstream and downstream applications. For instance, in September 2024, Sartorius AG launched Vivaflow SU, a tangential flow filtration system designed for more efficient ultrafiltration and diafiltration processes.

Rising investment in next-generation membranes presents lucrative growth opportunities. Market players are investing significantly to develop advanced membranes offering superior chemical compatibility, thermal stability, and high flow rates. Continuous research and development efforts are leading to smart membrane technologies that improve productivity in continuous bioprocessing environments.

Market Challenges and Restraints

Despite positive growth prospects, the market faces several challenges. Filter fouling emerges as a major restraint, occurring when particulate matter clogs filter media, reducing flow rates and filtration efficiency. This results in frequent filter replacements, increased operational costs, and process downtime, ultimately impacting overall productivity. Additionally, addressing fouling requires costly revalidation and quality checks.

Raw material variability poses another significant challenge, as even minor inconsistencies in composition or quality can substantially impact filtration product performance and reliability. This forces manufacturers to conduct additional testing, revalidation, and batch qualification, leading to increased costs and extended production timelines.

Speak To Analyst- https://www.fortunebusinessinsights.com/enquiry/speak-to-analyst/pharmaceutical-filtration-market-114711

Competitive Landscape

The pharmaceutical filtration market exhibits a concentrated structure with several key players dominating globally. Danaher Corporation, Merck KGaA, and Sartorius AG lead the market through extensive product portfolios, technological advancements, and strategic collaborations. These companies actively invest in technology development and maintain wide-ranging product offerings for efficient filtration systems.

Other prominent players include Avantor Inc., Cytiva, 3M, Repligen Corporation, Parker Hannifin Corp, Eaton, and Thermo Fisher Scientific Inc. These organizations are pursuing various strategic initiatives including research and development investments, acquisitions, partnerships, and geographic expansion to strengthen their market positions.

Ashwin Arora

Fortune Business Insights™ Pvt. Ltd.

+1 833-909-2966

sales@fortunebusinessinsights.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.