Contract Development and Manufacturing Organization (CDMO) Market to Register a Strong CAGR of 9.90% by 2034

The contract development and manufacturing organization (CDMO) market is projected to grow from USD 273.40 billion in 2026 to USD 580.72 billion by 2034.

PUNE, INDIA, February 7, 2026 /EINPresswire.com/ -- The global contract development and manufacturing organization (CDMO) market was valued at USD 255.01 billion in 2025 and is projected to grow from USD 273.40 billion in 2026 to USD 580.72 billion by 2034, exhibiting a CAGR of 9.90% during the forecast period. North America dominated the CDMO market with a market share of 38.50% in 2025. Market expansion is primarily driven by the increasing outsourcing of drug development and manufacturing activities, growing complexity of pharmaceutical pipelines, and rising demand for biologics, biosimilars, and advanced therapies such as cell and gene therapies. Pharmaceutical and biotechnology companies are increasingly relying on CDMOs to reduce capital expenditures, shorten development timelines, and gain access to specialized technologies and regulatory expertise.Contract Development and Manufacturing Organizations (CDMOs) provide end-to-end services across the pharmaceutical value chain, ranging from early-stage research and formulation development to clinical trial material production, commercial manufacturing, and packaging. Rising investments in R&D of innovative therapeutics, along with supportive government initiatives aimed at strengthening healthcare infrastructure and clinical trial ecosystems, are further accelerating market growth across major regions.

Top Companies in Contract Development and Manufacturing Organization (CDMO) Market

Lonza

Thermo Fisher Scientific Inc.

IQVIA

ICON plc

Syneos Health

Parexel International Corporation

Recipharm AB

Curia Global, Inc.

Vetter

Unither Pharmaceuticals

Get Free Sample Research Report:

https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/contract-development-and-manufacturing-organization-cdmo-outsourcing-market-102502

Contract Development and Manufacturing Organization Market Trends

One of the most prominent trends in the CDMO market is the rapid consolidation through mergers and acquisitions. Leading CDMOs are acquiring niche technology providers and regional manufacturers to broaden their service offerings and expand geographic presence. This trend is particularly strong in biologics manufacturing, sterile injectables, and cell and gene therapy production.

Another important trend is the rise of end-to-end service providers offering fully integrated solutions from discovery to commercialization. Pharmaceutical and biotechnology companies increasingly prefer single-vendor partnerships that can handle development, scale-up, and commercial manufacturing, reducing technology transfer risks and improving time-to-market.

Digitalization and smart manufacturing are also reshaping the CDMO landscape. Adoption of artificial intelligence, machine learning, digital twins, and advanced automation is improving process optimization, quality control, and predictive maintenance. In parallel, sustainability initiatives such as green chemistry, waste reduction, and energy-efficient facilities are gaining importance as CDMOs align with environmental regulations and corporate ESG goals.

Contract Development and Manufacturing Organization Market Growth Factors

The increasing outsourcing of clinical trials and drug manufacturing is a major growth driver for the CDMO market. Pharmaceutical companies are under pressure to accelerate development timelines while managing rising R&D costs. Outsourcing enables them to access specialized infrastructure and experienced personnel without heavy capital investment.

Growing demand for complex biologics, biosimilars, and personalized medicines further fuels the need for CDMO services. These products require sophisticated manufacturing technologies and stringent quality systems that many small and mid-sized biotech firms lack internally.

Rising drug development and manufacturing costs are also encouraging long-term strategic partnerships between pharmaceutical companies and CDMOs. Such collaborations allow sponsors to focus on core competencies such as discovery and commercialization while CDMOs handle technical and operational complexities.

However, stringent regulatory requirements across different regions may restrain market growth. CDMOs must comply with rigorous Good Manufacturing Practice (GMP) standards set by agencies such as the U.S. FDA and EMA, which increases compliance costs and operational complexity. Despite this, continuous investments in regulatory expertise and quality systems are helping CDMOs mitigate these challenges.

CDMO Market Segmentation Analysis

By service, the market is segmented into Contract Manufacturing Organization (CMO) and Contract Research Organization (CRO).

The CMO segment dominates the market, driven by strong demand for API manufacturing, finished dosage form manufacturing, and packaging services. Within finished product manufacturing, solid dosage forms and injectables account for a significant share due to their widespread use across therapeutic areas.

The CRO segment is expected to register the fastest CAGR during the forecast period. Growth is supported by rising outsourcing of early-phase development, preclinical studies, and clinical trials. Increasing complexity of clinical trial designs and regulatory requirements is encouraging sponsors to rely on specialized CRO service providers.

Speak to Analyst:

https://www.fortunebusinessinsights.com/enquiry/speak-to-analyst/contract-development-and-manufacturing-organization-cdmo-outsourcing-market-102502

Regional Insights

North America dominates the CDMO market, supported by a strong presence of leading CDMOs, a large number of ongoing clinical trials, and extensive collaborations between pharmaceutical and biotechnology companies. The U.S. represents the largest national market and is projected to reach USD 96.11 billion in 2026.

Europe holds the second-largest market share, driven by increasing biologics manufacturing, strong regulatory alignment with international standards, and active participation of CDMOs in global biotech conferences and partnerships. The U.K., Germany, and France are major contributors to regional growth.

Asia Pacific is projected to witness strong growth due to expanding biopharmaceutical manufacturing capacity, increasing R&D investments, and supportive government policies in China, India, and Japan. China is expected to reach USD 20.37 billion in 2026, while India and Japan are projected to reach USD 17.48 billion and USD 12.28 billion, respectively.

The rest of the world is expected to grow steadily, supported by cost-effective clinical trial environments and improving healthcare infrastructure in emerging economies.

Key Industry Developments

• March 2025: ICON plc partnered with Mural Health Technologies, Inc. to integrate the Mural Link participant management and payments platform into upcoming trials.

• February 2024: Novo Holdings announced the acquisition of Catalent, Inc. for USD 16.5 billion.

• February 2024: Unither Pharmaceuticals partnered with ONCOVITA to develop a combined prophylactic vaccine for pediatric infectious diseases.

• November 2023: Syneos Health signed an agreement with P3 Research Ltd Network to expand clinical trial capabilities in New Zealand.

• May 2023: Worldwide Clinical Trials collaborated with NEXT Oncology to expand presence in Spain.

Related Reports

Europe Contract Research Organization (CRO) Services Market Size & Industry Analysis

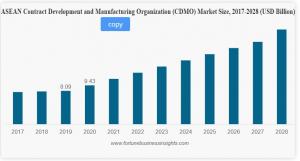

ASEAN Contract Development and Manufacturing Organization (CDMO) Market

Ashwin Arora

Fortune Business Insights™ Pvt. Ltd.

+1 833-909-2966

sales@fortunebusinessinsights.com

Visit us on social media:

LinkedIn

Facebook

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.